Why Having Multiple Credit Cards Helps Your Credit Score

There are a lot of common myths about credit cards that put people off of this points and miles game. Understanding what goes into your credit score can make you a pro at this.

I talk to a ton of people about credit cards and the most common thing I hear is that they don’t want to open another credit card because it will hurt their credit by having too many cards.

That’s a fair concern to have but the reality is having multiple credit cards will actually HELP your credit score.

Outlining what actually impacts your credit score will help show that the more credit cards you have improves your credit score substantially. Thinking about it from the lenders perspective will help.

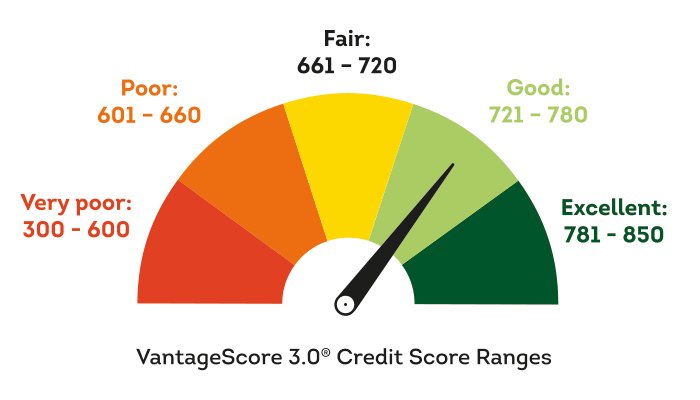

Your credit score can range from 300 on the low end to 850 on the high end. Many consumers think that having an 850 credit score is the equivalent to winning the World Series. However, anything over 720 is good enough for credit cards. When getting other loans like car loans or mortgages, you can get better rates by having a score above 750.

What are the factors that go into your credit score?

There are five main factors that go into your credit score.

What are they?

35%: Payment History- Do you pay your bills on time?

30%: Credit Utilization Ratio- How much of your available credit do you use?

15%: Credit Age- What is the average age of your credit?

10%: Types of Credit Used- Are you using credit cards, mortgages, personal loans, car loans, etc?

10%: Credit Inquiries- How many times have you applied for new credit

Let’s break these down

Payment History- 35%

This is obviously a big factor as it lets your lenders know that you pay your bills on time. When banks are lending you money they want to know you are going to pay them back! The only negative mark on your score is if there are any late payments. Late payments remain on a credit report for up to seven years from the original delinquency date, the date of the missed payment. The late payment remains on your credit report even if you pay the past-due balance. For instance, if you had a late payment in April 2011, the late payment would come off your credit report April 2018, seven years after the date of the missed payment. Having one late payment can kill you if you only have one credit card or loan. Set these up for auto-payment so you never miss one. Having multiple sources of credit means that one late payment over multiple credit cards and loans means that it won’t hurt nearly as bad.

Credit Utilization Ratio- 30%

What is credit utilization? Its simply the amount of credit you use divided by the total amount of credit you have. Even if you pay your cards off every month (which I of course strongly recommend), you are still using credit each month. So if you spend and pay off $3,000 a month on your credit card and you have a $6,000 credit line, you are still utilizing 50% of your available credit. Credit bureaus want to see under 30% credit utilization.

How can I improve my credit utilization ratio?

Reduce your revolving credit balances.

Spend Less

Pay your bill in full before the lender reports your balance to the credit bureaus

Increase your credit limit

You can easily ask the lender to increase your credit limit. This can usually be done easily online or by calling in.

Get a new credit card!

This is one of the easiest ways to increase your credit utilization ratio and you get all the benefits of a new card from the sign up bonus to the additional perks offered

Getting a new card can be the best way to improve your credit utilization ratio. If we get a new card with another $6,000 credit limit you now are only spending $3,000 a month but have $12,000 of available credit. This means that you now have a 25% credit utilization ratio which is under the 30% threshold.

This is the biggest myth out there about getting new credit cards. It seems somewhat counter intuitive that the more credit cards you have the better your credit score will be.

Credit Age: 15%

Your credit age is a tricky one in that we can’t improve it much. Your credit age is an average of the age of all your credit accounts. If you were lucky and opened your first credit card early on this will help you a lot. If you are new to the credit card game, this probably won’t help you much at all. This factor in your credit score is why you probably should never close that first no annual fee card you got in college. Having a credit card that has been around for years shows the lenders that you are responsible with your credit accounts. My rule of thumb is in most circumstances you should never cancel a credit card if it doesn’t have an annual fee as it only will help your credit score (assuming you’re responsible with it of course). This is another big myth people have when they want to close an old card thinking its hurting their credit score.

Types of Credit: 10%

The fourth part of your credit score is the types of credit you have.

Revolving- these are things like credit cards and home equity lines of credit where you have a credit limit that you can use and then you pay it back over time. When you spend on your credit card it reduces your available credit but it opens back up again once you pay it off.

Installment- installment credit is where you pay a flat payment each month. Examples of this type of credit are mortgages, car loans, and student loans.

Open- This is less common but comprises things like charge cards where there isn’t a set spending limit or credit line. You can spend as much as you want but you have to pay it back at the end of each billing cycle. Historically, American Express has been a charge card issuer but now their Membership Rewards earning cards are more of a hybrid where you can choose to pay over time with interest.

Lenders don’t necessarily need to see a wide variety of types of credit on your report but its nice to have. If you only have student loans, however, it may not look as good. Payday loans are also a red flag for them.

Credit Inquiries- 10%

This is where your credit score can actually be negatively impacted by opening new credit cards. Each time you apply for credit it will show up on your report as an inquiry and can ding your score by a few points. In the grand scheme of things a few points isn’t going to make a huge deal when your credit score can go up to 850. In fact, the improvement of your credit utilization ratio can offset that negative impact to your credit score and cause your score to go up! The good thing about credit inquiries is that they fall off after your report after 2 years and only impact your score for 12 months.

Wrapping Up

As you can see there are a lot of factors that go into your credit score which are pretty easy to change. Most of the myths out there like having too many credit cards will hurt your credit score are just false and can actually improve your credit score!

The responses below are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved, or otherwise endorsed by the bank advertiser. It is not the bank advertiser's responsibility to ensure all posts and/or questions are answered.